Amid an onslaught of negative credit news, there are some bright spots. So-called Rising Stars, sectors whose credit quality has moved from high-yield or “junk” status to investment-grade, are growing, slowly but surely.

According to consensus credit data from Credit Benchmark, which gathers the collective credit quality estimates of lenders to these firms, the total number of new Rising Stars has increased by 49 from the prior update.

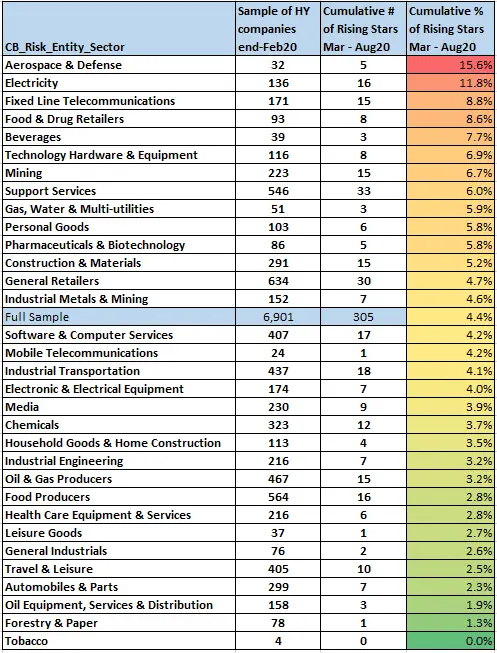

Each month, Credit Benchmark tracks a global sample of corporations across all sectors to gauge the percentage of firms that have improved to investment-grade status. This month’s report captures consensus credit data for 6,901 companies that were classified as High Yield as at end-Feb 2020 and finds that since that time, 305 (about 4%) have migrated into Investment-grade, based on the internal risk views of over 40 leading global financial institutions. Of the 32 sectors examined, 14 have a higher percentage of Rising Stars than the average for the full sample.

Aerospace & Defence has the highest percentage of Rising Stars at 16%, followed by Electricity at 12% and Fixed Line Telecommunications at 9%. Of these three, Electricity is the sector whose percentage has grown.

Other sectors with rising stars include but are not limited to Food & Drug Retailers, now at 9%; Support Services, now at 6%; General Retailers, now at 5%; Industrial Transportation, now at 4%; and Food Producers, now at 3%.

In part, the positions of these sectors reflect underlying strength. The Health Care Equipment & Services sector, for example, is heavily skewed toward investment-grade names and is therefore less likely to see a great deal of month-to-month volatility in the number of new rising stars.

Ongoing economic malaise and uncertainty continue to make it difficult for many sectors to show significant improvement in credit quality. Travel & Leisure, for example, will face multiple pressure points, including reduced vacationing amid safety concern. Airline job cuts are already close to 50,000. In turn, that will weigh on Oil & Gas Producers and Oil Equipment, Services & Distribution – all of whom have been slow to show any signs of credit quality improvement. Recent news for the energy sector is scarcely better, whether it’s US energy firms or those around the world.